Ira distribution tax calculator

How is my RMD calculated. Calculate IRA Distribution Tax If you have a traditional IRA first figure out the taxable portion by subtracting any nondeductible contributions made from the IRAs value at.

Ira Future Withdrawal Calculator Forecast Rmds Through Age 113

More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

. Roth IRA Distribution Tool. See When How Much You Need To Begin Withdrawing From Your Retirement Savings Each Year. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from.

Ad Use This Calculator to Determine Your Required Minimum Distribution. For comparison purposes Roth IRA. See When How Much You Need To Begin Withdrawing From Your Retirement Savings Each Year.

Account balance as of December 31 2021. When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take. Ad Whats Your Required Minimum Distribution From Your Retirement Accounts.

Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation. Ad Visit Fidelity for Retirement Planning Education and Tools. Traditional IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

IRA Calculator The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. Use our traditional IRA calculator to see how much your nest egg will grow by the time you reach retirement. Calculate the required minimum distribution from an inherited IRA.

Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a. That is it will show which amounts will be subject to ordinary income tax andor. This tool is intended to show the tax treatment of distributions from a Roth IRA.

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. Regardless of your age you will need to file a Form 1040 and show the amount of the IRA withdrawal. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year.

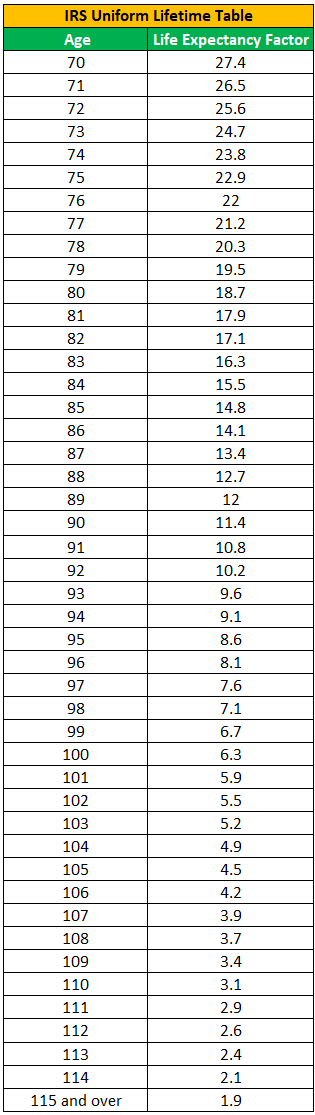

If you want to simply take your. Your life expectancy factor is taken from the IRS. Ad Whats Your Required Minimum Distribution From Your Retirement Accounts.

IRA Minimum Distribution Calculator Required minimum distribution Calculate your earnings and more The IRS requires that you withdraw at least a minimum amount - known as a Required. Calculate your earnings and more. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset.

Colorful interactive simply The Best Financial Calculators. For example if you have a 100000 traditional IRA and have made 15000 in nondeductible contributions over the years the nondeductible portion is 015. To calculate your required minimum distribution simply divide the year-end value of your IRA or retirement account by the distribution period value that matches your age on.

Traditional IRA Calculator Details To get the most benefit from this. Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs. Since you took the withdrawal before you reached age 59 12 unless you met one.

Ready To Use Traditional Ira Calculator 2021 Msofficegeek

Ready To Use Traditional Ira Calculator 2021 Msofficegeek

Retirement Income Calculator Faq

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Tax Calculator Estimate Your Income Tax For 2022 Free

Traditional Vs Roth Ira Calculator

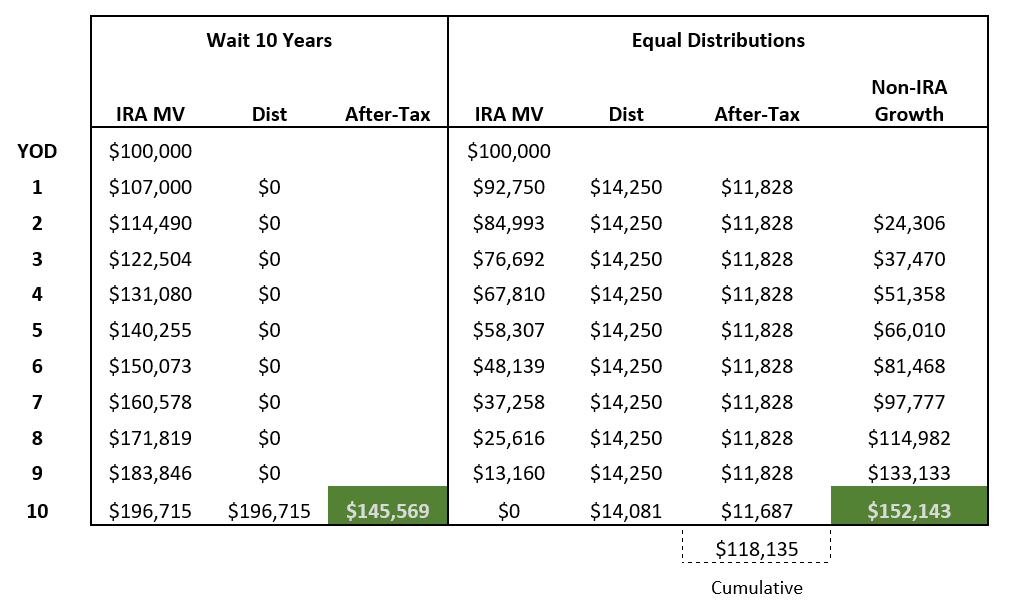

Understanding The Secure Act Managing The 10 Year Rule Financial Planning Insights Manning Napier

Required Minimum Distribution Calculator Estimate The Minimum Amount

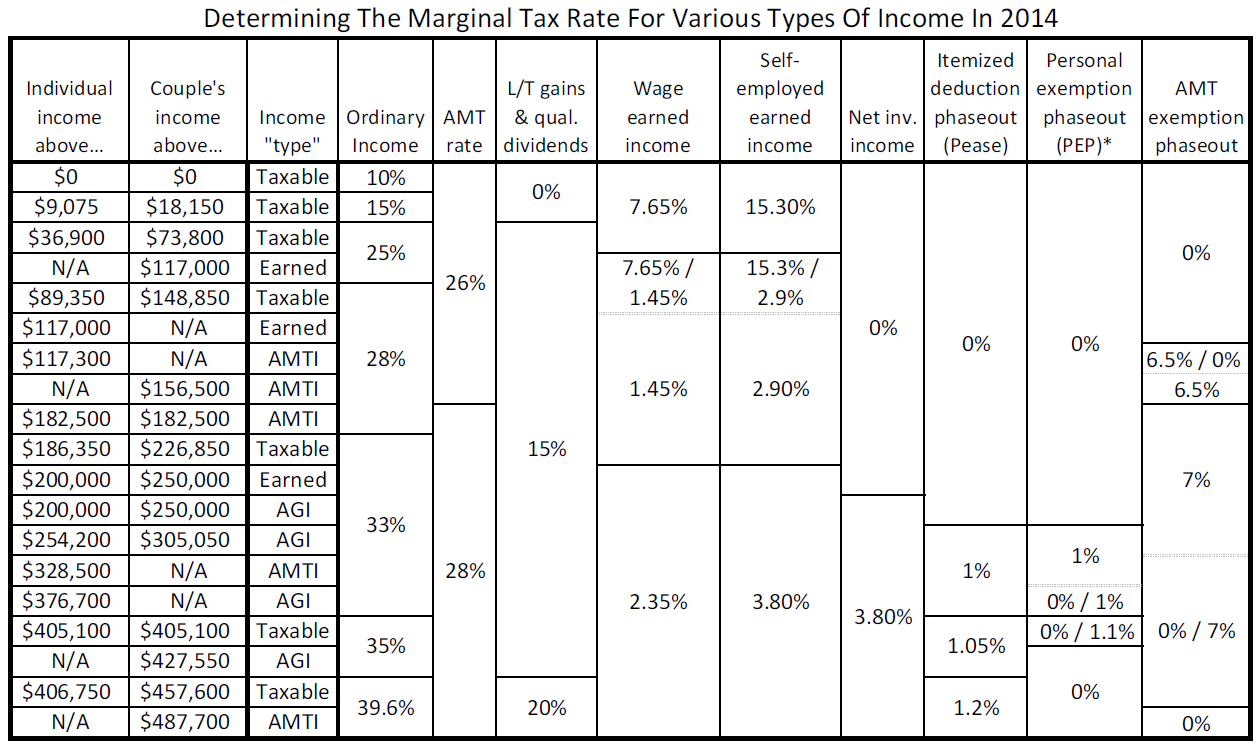

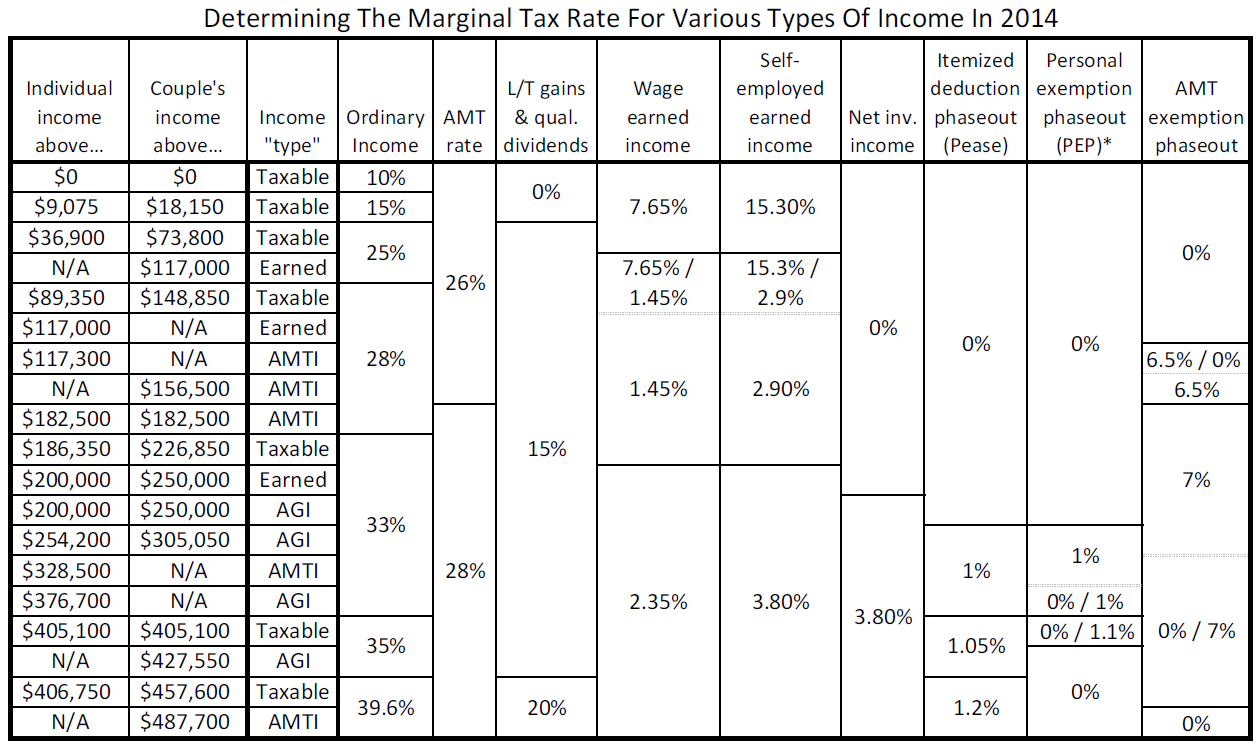

How To Evaluate Your Current Vs Future Marginal Tax Rate

Retirement Withdrawal Calculator For Excel

Roth Ira Calculator Roth Ira Contribution

Tax Withholding For Pensions And Social Security Sensible Money

Traditional Vs Roth Ira Calculator

Canadian Foreign Tax Credit On Ira Distribution